8. Where do you invest?

Today, you can invest with your bank or a dedicated Investment Platform. They may provide all sorts of investment accounts (Aktiesparekonto, Saving Accounts, ...) or investment products.

There's a significant price difference depending on the bank or investment platform you use for trading. With Investment Platforms, we mean platforms that provide only investment services such as SAXO or Nordnet

From 7. Costs of Investing we've seen brokerage, custody and foreign exchange fees.

Traditionally, banks are known to be more expensive compared to pure Investment Platforms like SAXO or Nordnet. The latter ones don't have Custody fees, meaning you only pay Brokerage and, if applicable, Foreign Exchange fees.

The Danish internet has battled for a long time which Investment Platform is better. SAXO has the clear advantage that it provides a larger product palette and the platform exists in multiple languages. Nordnet is in Danish only, but offers pension accounts. SAXO offers access to 31 stock exchanges, whereas Nordnet provides access to only 8. Since recently, both Nordnet and SAXO have "Månedsopsparing" (Eng: Monthly savings). "Månedsopsparing" is not an account, but a service that automatically invests each month an amount into a product(s) of your choice without brokerage fees! (we will further discuss Månedsopsparing in [[13. Investing Strategies#3. Månedsopsparing]])

Regardless of which one you pick, you'll make a good choice with either one. Nordnet and SAXO both provide Aktiesparekontos and automatically report to SKAT.

Order Types

Investors have different ways to buy Securities on Stock Exchange Markets. These ways are called Order Types.

Two of the most basic Order Types are Market Orders and Limit Orders.

Market Orders

If you place a buy Market Order, you are saying, "I want to buy this Security right now at whatever price someone is willing to sell it for".

Similarly, if you place a sell Market Order, you are saying, "I want to sell this Security right now at whatever price someone is willing to buy it for." The main advantage of a Market Order is that it gets executed quickly, but you don't have control over the exact price you'll pay or receive.

Limit Orders

A Limit Order is a type of order you place to buy or sell a Security at a specific price that you choose. When you place a buy Limit Order, you set the highest price you are willing to pay for the Security. Your order will only be filled if the price drops to that level or lower. When you place a sell Limit Order, you set the lowest price you are willing to accept for the Security. Your order will only be filled if the price rises to that level or higher.

These Limit Orders actually make up the Ask prices (for sell Limit Orders) and Bid prices (for buy Limit Orders) in the market. In fact, these are the prices that determine the buy/sell prices for Market Orders.

The advantage of a Limit Order is that you control the price at which the trade happens, but there's no guarantee that your order will be executed if the market doesn't reach your specified price.

Example

Imagine you want to buy Shares of a company. If you place a Market Order, you are saying, "I want to buy these Shares right now at the current market price." Let's say the current price is 300 DKK. Your order will only be filled at around 300 DKK, but it might be slightly higher or lower depending on what the sellers (those placing Limit Orders) are asking for at that moment.

On the other hand, if you place a Limit Order with a maximum price of 296 DKK, you are saying, "I want to buy these shares, but only if I can get them for 296 DKK or less." Your order will only be filled if the price drops to 296 DKK or below. If the price stays above 296 DKK, your order won't be executed.

Stock Exchanges

When investing through platforms like SAXO or Nordnet, they're just facilitating access to many Stock Exchange markets where the actual trading happens.

Here are some popular Stock Exchanges markets from a Danish viewpoint:

| Name | Country | Market Code | Opening hours (Denmark Time CET/ UTC +1) | Note |

|---|---|---|---|---|

| NASDAQ | USA | XNAS | Monday to Friday 15:30 to 22:00(Varies for Summer and Winter time) | Offers most American Stocks |

| Deutsche Börse XETRA | Germany | XETR | Monday to Friday 9:00 - 17:30 | You read correct, XETRA is the name and XETR is the code |

| Milan Stock Exchange | Italy | XMIL | Monday to Friday 9:00 - 17:30 | |

| London Stock Exchange (LSE) | United Kingdom | XLON | Monday to Friday 9:00 - 17:30 | |

| Euronext Amsterdam | Netherland | XAMS | Monday to Friday 9:00 - 17:30 | Do not imply that "Euronext" = "Euronext Amsterdam". Euronext is a group of stock exchanges and there is also Euronext Brussels (XBRU) as an example |

Remember: Stocks, ETFs, and Danish Investment Funds are traded on Stock Exchanges. However, Bonds and Mutual Funds are bought and sold directly from the companies that offer them. They might look like they're traded like Stocks on investment platforms, but they're not.

Danish Investment Funds

Danish investment funds — such as Danske Inv Global Indeks, kl DKK d (Dis) (DKIGI) — are not available for trading at market open (09:00). This is because they must wait for the legally required Net Asset Value (NAV) (the per-unit worth of the fund’s underlying holdings after converting everything to DKK and subtracting costs) to be calculated. This process must be completed by 9:45 and only after this deadline are the exchange and brokers permitted to enable trading.

Pre-market & After-hours trading

USA Stock Exchange markets—particularly the New York Stock Exchange (NYSE) and the NASDAQ—typically open at 9:30 (15:30 CET/Danish time) and close at 16:00 Eastern time (22:00 CET/Danish time).

However, thanks to Pre-market and After-hours trading, investors can buy and sell as early as 4:00 (10:00 CET/Danish time) and as late as 20:00 Eastern time (2:00 CET/Danish time the following day). These periods are also known as Extended hours. Not all platforms support these trading periods, as they carry several risks. Since these periods only have a few participants, there is no guarantee that a particular trade will be executed and the markets are highly volatile with high price swings. Moreover, only Limit Order types are available during pre-market and after-hours trading.

15-min Delayed

When you are ready to invest, you might notice a "15 minutes delayed" note next to the "Open" indicator on SAXO or a clock icon on Nordnet. This indicates that real-time data for some markets, such as the USA and Canada, is a premium feature and the data you see is 15 minutes old

For low-volatility Securities, this delay is generally not an issue. However, for day trading, especially with high-volatility Stocks, a 15-minute delay can have catastrophic consequences.

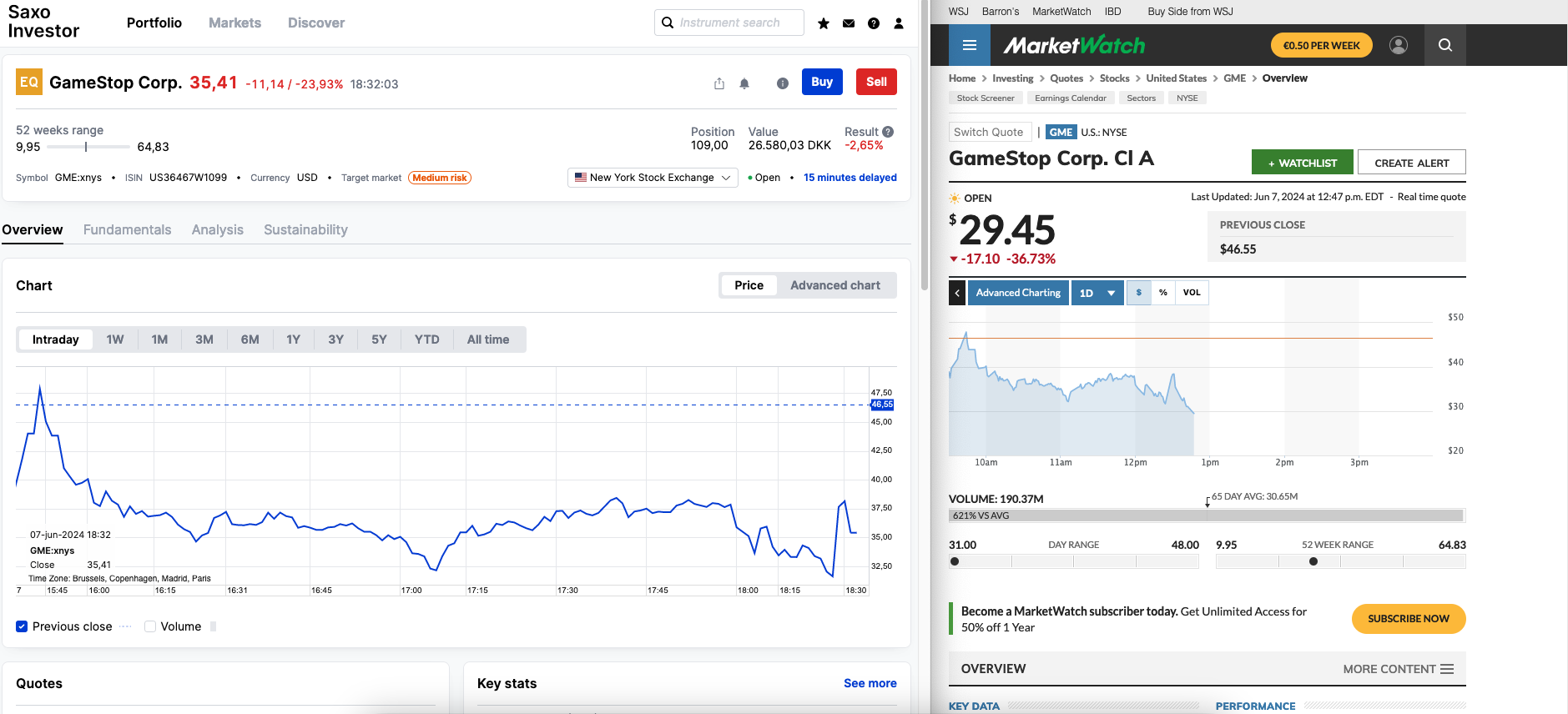

For example, on June 7th, 2024, the price of GameStop (GME) fluctuated significantly. Imagine wanting to sell stocks at a market price of 35 USD, only to find they were actually sold for 29 USD because SAXO's data was 15 minutes behind. The screenshot from that date below illustrates this scenario.

It's always a good idea to check the real-time price of a stock on Marketwatch or Yahoo Finance, both of which offer free real-time prices.